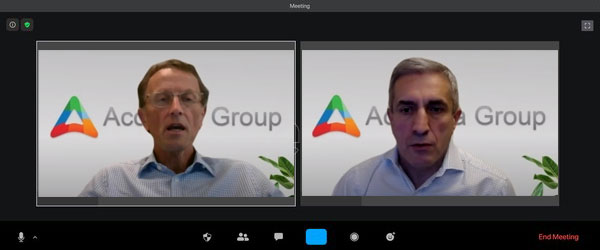

Accordia is delighted to welcome our regular market commentator Mark Tinker to a discussion with Angelo Robles.

Accordia is delighted to welcome our regular market commentator Mark Tinker to a discussion with Angelo Robles.

Accordia Group is delighted to welcome two of industry’s most respected experts in the digital automation space to discuss the backdrop for a massive surge in new economy related capital spending, and how the impending skilled labor shortage will need to rely increasingly on AI…

Accordia Group is delighted to welcome two of the mining industry’s most respected experts to discuss the causes and implications of many years of under-investment…

Accordia Group is delighted to welcome the host of the global investment newsletter, Market Thinking, to an interview with Family Office Association Founder, Angelo Robles.

Does GDP growth establish energy demand and hence pricing, or is the global economy facing a period of substantial subpar or even zero growth due to physical energy production limits.

Andrew Ertel and Benedikt Von Butler recently joined Angelo Robles of the Family Office Association and David Talbot, Head of Ruby business development to discuss their recently launched Premium Carbon Offset Fund.

The share price chart of Carbon Streaming has fallen 73% since the turn of the year while regulated carbon prices in the European ETS scheme are close to all time highs…

The Accordia Group is supporting a thought leadership series by the Family Office Association covering topics that drive demand for agile portfolio management solutions for funds and asset managers.

Accordia Group’s Decarbonization Blindspot is always on the look out for ways to benefit, both socially and financially, from the rush to decarbonization. Work on our Ruby Carbon Platform has…

On a recent Family Office Association podcast, founder Angelo Robles delved into the ever-changing world of energy markets and decarbinization, and the unforeseen impacts on financial markets.

Angelo interview featured analysis from…

The world is emitting 35 Billion Tonnes of CO2 annually – 55BT if including other Green House Gases (GHG). Amidst the dire apocalyptic climate projections, it is pleasing to see just how…

There’s tremendous disruption in energy right now. Today’s “net zero” carbon targets and the restart of a post pandemic economy have created opportunities and risk for investors.

Trading activity in carbon markets…