Just Stop Oil Protest in London

Does GDP growth establish energy demand and hence pricing, or is the global economy facing a period of substantial subpar or even zero growth due to physical energy production limits. We would argue a pending oil supply shortage may limit global growth very substantially until adjustments can be made, even if war in Ukraine can mercifully end. Renewables may be the biggest winner of all.

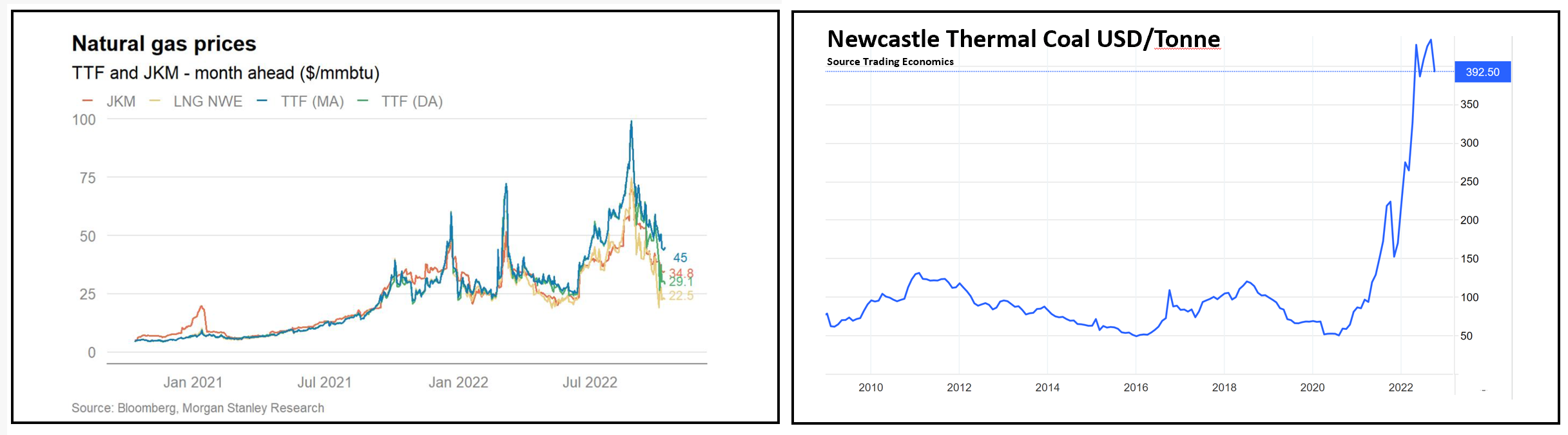

It can readily be argued natural gas and coal prices have recently entered a period of substantial price induced demand destruction:

Trading between $2 and $12 per mmbtu for the previous ten years, the removal of Russian supplies from Europe saw prices for pipeline gas and LNG trade upwards of $50, although pulling back recently into the twenties. Morgan Stanley recently forecast natural gas demand destruction in Germany to be averaging 8%. Seaborne thermal coal pricing has exhibited a similar trend with prices rising fivefold to $400/Tonne. Talks of China increasing coal output by 300MT suggests a similar easing in price action may be close. Further, nuclear power utilization levels worldwide are receiving strong price signals.

Trading between $2 and $12 per mmbtu for the previous ten years, the removal of Russian supplies from Europe saw prices for pipeline gas and LNG trade upwards of $50, although pulling back recently into the twenties. Morgan Stanley recently forecast natural gas demand destruction in Germany to be averaging 8%. Seaborne thermal coal pricing has exhibited a similar trend with prices rising fivefold to $400/Tonne. Talks of China increasing coal output by 300MT suggests a similar easing in price action may be close. Further, nuclear power utilization levels worldwide are receiving strong price signals.

European governments have so far committed approximately EUR700B of emergency funding, more than 4% of GDP, in the forthcoming year, to ease the burden on consumers, which in turn is avoiding additional demand destruction.

Almost all of this European energy crisis can be laid squarely at the feet of Putin’s war in Ukraine. The remarkable speed with which Europe has adjusted to losing Russian sourced gas that previously made up 44% of the northern European supplies, speaks to the robust global supply chains especially in LNG.

Seeing this weekend’s dramatic protests by the group calling themselves “Just stop oil”, it should encourage us to ask, “what if oil production has just peaked?”

Our friends at Family Office Network recently interviewed Mike Rothman of Cornerstone Analytics. Mike has been the leading global oil supply demand analyst for forty years and his views should be foundational in understanding the global energy picture. Summarizing the interview, his key views are:

- 72% of oil demand comes from largely price inelastic transportation (24% petrochemicals)

- Oil demand growth typically runs at 50% of GDP growth.

- Exploration & development capital spending fell by a stunning $2.6Tr since peaking in 2014

- Demand has recently expanded by 1mb/d due to diesel switching for power generation

- The IEA (defacto global data source) routinely understates global oil demand by 1%

- Non-OPEC growth almost all comes from North America – IT IS NOW EX-GROWTH

- The OPEC supply cushion is less than 1mb/d despite their recent claim to cut by 2mmb/d

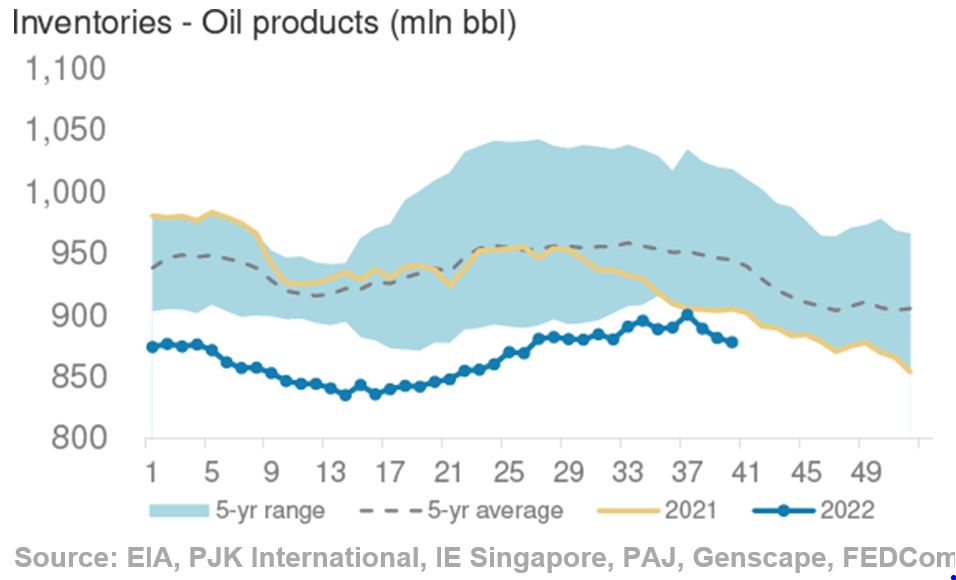

- Global oil stocks have consistently fallen despite depressed Chinese growth rates

Conclusion

Unstable countries like Libya, Nigeria and Iraq represent further supply risks. Russian price caps and sanctions likely limit growth or threaten contraction. Asymmetric price action in supply constrained markets, already demonstrated clearly in coal and gas, incentivize OPEC and Russia to limit output. Continued releases from the Strategic Petroleum reserve must eventually be reversed. Q4 demand always represents the strongest seasonal demand pull. There is a severe risk that global oil production has tapped out. Oil prices may be set to find where demand destruction emerges which Rothman’s models suggest should be nearer to previous peaks of $150/bbl. Considering natural gas traded well over $300/bbl equivalent, such numbers may be more than realistic. With the entire energy network receiving such robust price signals, renewables may just be getting a much bigger boost than expected, and Aston Martin can’t switch to EV’s too soon.

The full interview with Mike can be seen at the Family Office Association by contacting Kathleen Tepley at kathleen@familyofficeassociation.us

Parties interested in subscribing to Mike’s work should contact Oliver Parsons at oliver@cornerstoneanalytics.com to subscribe for Cornerstone research.

For a taste of the interview: